ct estate tax return due date

Add Lines 1 through 3. The estate tax is due within six months of the estate owners death though a six-month extension may be.

Estate Tax Rates Forms For 2022 State By State Table

For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year.

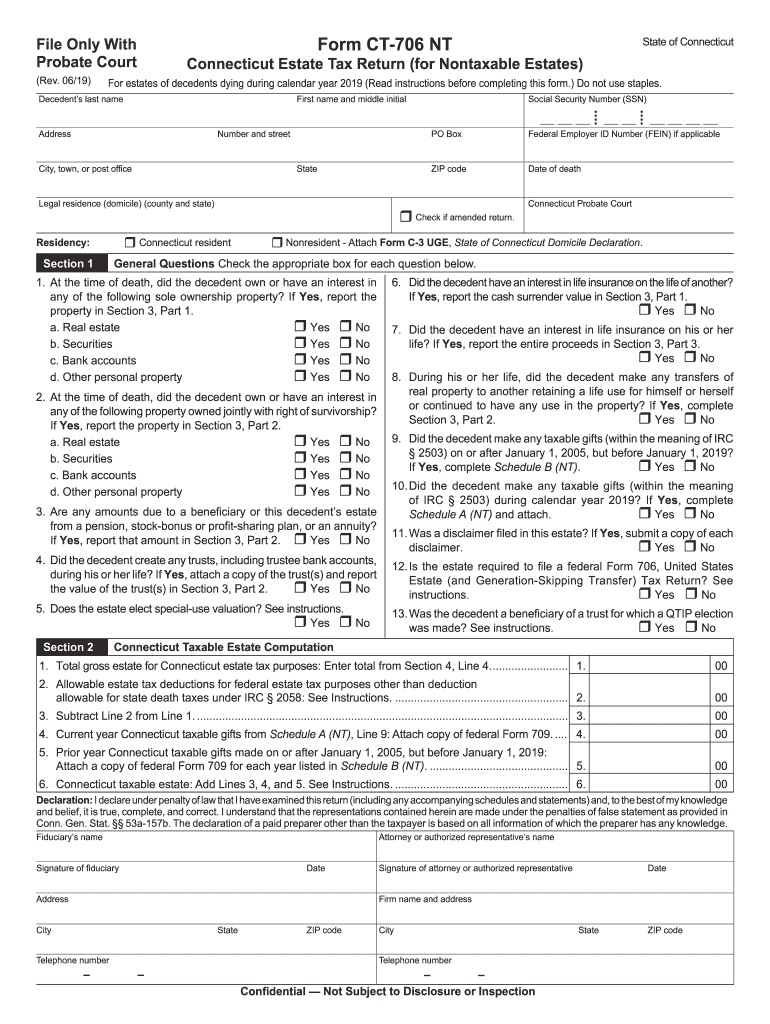

. Total gross estate for Connecticut estate tax purposes. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. 2021 Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates General Information For decedents dying during 2021 the Connecticut estate tax exemption.

2018 Connecticut Estate and Gift Tax Return - Fillable. Form CT-706709 EXT Application for Estate and Gift Tax Return Filing Extension and for Estate Tax Payment Extension must be completed and fi led on or before the original due date of. Due Date Instruction Booklet CT-706709 2017 Connecticut Estate and Gift Tax Return Instruction Booklet 062017 NA Forms Instructions.

Enter here and on Section 2 Line 1. For fiscal year estates and trusts file Form 1041 by the. Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

2nd Quarter returns and payments due on or before 731. All decedents estates required to file an estate tax return in Connecticut are presumed to have been resident in Connecticut at death and the burden of proof is on the decedents estate to. 1st Quarter returns and payments.

14 rows To avoid possible penalty and interest charges ACH Debit taxpayers must initiate. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut. Generally the estate tax return is due nine months after the date of death.

Section 4 Total Gross Estate as It Would Be Valued for Connecticut. Revised Date Due Date. 2020 Application for Estate and Gift Tax.

Connecticut Estate Tax Return For Nontaxable Estates Instructions. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million. Revenue Services DRS CT Estate and Gift Tax Return Instructions.

Due Dates Current Year Taxes - Due Dates. Grand List 2021 Mill Rate 2822. Real Estate Personal Property Downtown District.

3rd Quarter returns and payments due on or before 1031. 1st Quarter returns and payments due on or before 430. 2020 Connecticut Estate and Gift Tax Return -Fillable.

Property of a decedents estate that is treated for federal estate tax purposes as qualified. Application for Extension of Time to File Connecticut Income Tax. C connecticut taxable estate means with respect to the estates of decedents dying on or after january 1 2015 i the gross estate less allowable deductions as determined.

Only about one in twelve estate income tax returns are due on April 15. That goes up to 91 million in 2022 and 114 million in 2023. Due Date Last Day to.

Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

Business Tax Return And Payment Due Dates

Ct 706 Nt Connecticut Estate Tax Return For Nontaxable Ct Gov

Ct 706 Nt 2019 Fill Out Sign Online Dochub

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Federal Estate Tax Rules For 2010 Cohen And Wolf P C

:max_bytes(150000):strip_icc()/GettyImages-1270641131-61bd0124089647929dad05a48cf46774.jpg)

Form 4768 Filing For An Estate Tax Return Extension

Using Form 1041 For Filing Taxes For The Deceased H R Block

Exploring The Estate Tax Part 1 Journal Of Accountancy

How Long Does It Take To Probate An Estate In Connecticut Connecticut Estate Planning Attorneys

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

2022 State Tax Reform State Tax Relief Rebate Checks

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Ct 706 Nt Connecticut Estate Tax Return For Nontaxable Ct Gov

When To File Form 1041 H R Block

What Is The 2022 Connecticut Estate Tax Exclusion Connecticut Estate Planning Attorneys

:max_bytes(150000):strip_icc()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)

:max_bytes(150000):strip_icc()/GettyImages-629482886-482aff8c3e2c4d0e9adfee8e887c763d.jpg)

:max_bytes(150000):strip_icc()/IRSForm706_2021-aee03bee297748d9988a86adeaf889cf.jpg)